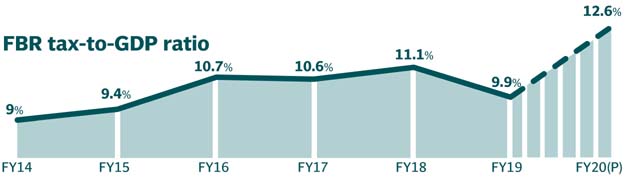

A progressive, fair, transparent and simple taxation system lies at the heart of a strong and successful economy. Pakistan’s tax policy, however, according to most experts is regressive, unfair, opaque and complex, and tax administration is one of the most unproductive and corrupt anywhere in the world. The current tax regime is one of the key reasons behind the distortions in the economy and at the heart of why the country’s tax-to-GDP continues to hover around 10pc, one of the lowest in the world.

A recent Editorial in Dawn, titled ‘No FBR Reform’ stated “there is hardly anyone who shows any trust in the nation’s tax system. Though it’s a misplaced argument, most people, especially businesspersons, would gladly pay more to the government indirectly than become part of a cumbersome system. The tiny number of tax filers — who overwhelmingly comprise salaried persons — and the collection of more than two-thirds of income tax through indirect withholding or advance tax regimes testify to this sad fact. Similarly, our ports remain porous as Customs allows everyone to understate or overstate the value of their international trade transactions according to their financial interests — albeit for a price. The admission by senior officials of the FBR before a parliamentary panel that refund claims of over Rs532bn had been blocked since 2014 to show higher growth in collection speaks volumes for the performance of its 20,000-odd staffers, and how the board operates to hoodwink government and people alike.”

According to the Editorial the Imran Khan government “has been struggling to turn around the FBR. During this period, four FBR chairpersons, including one borrowed from the private sector, have had to leave for failing to improve performance. An attempt to replace the FBR with the proposed Pakistan Revenue Authority in winter was thwarted by its senior officers who refused to accept any restructuring or reform plan unless it was ‘approved’ by them. Previous attempts at reform had also failed owing to stiff resistance from the board’s senior officers. The changes in the now defunct CBR Act in 2007 had resulted in its rechristening as the FBR but there was still no improvement in the revenue authorities’ culture or performance. With the country’s fiscal situation becoming untenable mainly because of the FBR’s incompetence to document the economy and generate enough tax revenues, the government urgently needs to implement serious tax policy and administrative reforms. These reforms should focus on documentation of the large informal economy, elimination of presumptuous taxation and withholding regime, dismantling of incentives for tax evasion and dishonesty, simplification of tax laws, reduction in indirect taxation, and so on, besides ensuring transparency and full disclosures.”

Finally, the objective of any government “should be to evolve a tax policy that supports economic growth and bridges growing inequality in society by removing tax exemptions and taxing all incomes irrespective of their source. As indicated, any move at reform should anticipate opposition from within the FBR. The success of the effort will depend on the government’s will to stand up to vested interests for the greater public good.”

![]()